Among main questions of aspired entrepreneurs heading for venture capital is about dilution of own share they should agree to in the preseed round, then seed round, and how much in the future it can be, which investor’s requirements are normal and fair, and which are not.

Also, one of the first tasks for a startup founder is the dilemma of how much to allocate for options, what positions to evaluate at what share. Usually, a startup does not have enough money to pay competitive market salaries, so it lures valuable personnel with the promise of a share in the company.

If a shareholder pays competitive remuneration to hired employees, then inviting them to the company’s capital is usually not required. The notorious motivation from participating in the capital of a private, non-listed (and therefore illiquid) and unprofitable (and therefore not paying dividends) company is often overestimated by shareholders and the company’s management – ordinary employees do not feel the desired effect.

Carta issued a useful presentation with startup statistics (I’m adding it to the channel chat). I believe that they are mostly American. Nevertheless, the information reflects the reality that existed for successful Russian tech companies that raised rounds before 2022.

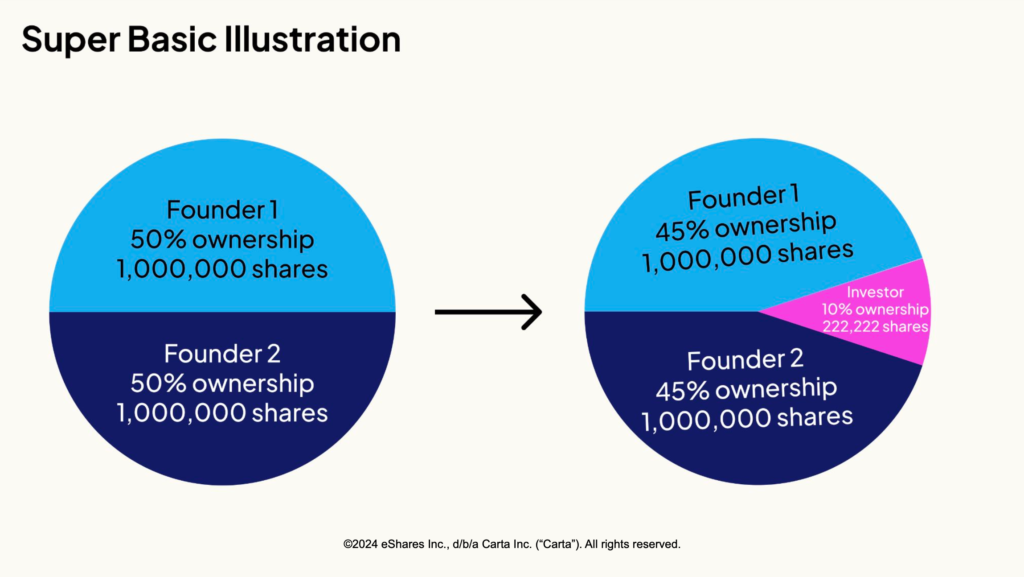

I’m sure not everyone understands what is actually meant by the term “dilution”. Dilution occurs with shareholders’ shares when new shares are issued or shares are issued. Provided that current shareholders do not participate in the new issue proportionally to their ownership. If all current shareholders proportionally want to participate in the investment round in order not to be diluted, then they themselves will buy the entire new issue, and the new shareholders will get nothing.

This is essentially additional financing at the expense of current shareholders of the business. In this case, a new issue of shares is not required, there is no need to change the documents (if the areas of responsibility and rights of shareholders do not change), raising money can be formalized by a loan or an increase in the company’s capital.

So, the standard issue for a seed round is 10-20% of shares from the capital. If the pre-seed round is financed by the founder himself or a group of founders from their own resources, sometimes with the participation of a startup accelerator, then funds from angel investors are attracted at the seed round. Usually these are 2-3 people, but there can also be syndicates of several dozen participants, each of which invests 10-20 thousand dollars.

Of course, it is better to have fewer participants in the captable (a table with shares in the capital), since each additional investor is a burden on the founder and his team for the entire existence of the company, but especially at the beginning, when raising the first investments. Even the most understanding and calm investors ask awkward questions from time to time and request additional documents, or even want to meet. This takes away the startup team’s time and energy from directly developing the product and building business processes.

In the case of an option plan, 10-15% is usually allocated for distribution among key employees.

Often, investors in initial rounds want the option plan to be allocated from the founders’ shares, but in general this is a negotiable issue of the initial termsheet (list of investment conditions).

Then the option plan is distributed among key employees of the company in the amount of 0.1% in the case of administrative staff and developers to 5% for a hired CEO.

It turns out that at the seed round, due to the issuance of shares to investors and the allocation of an option program, the founders are diluted by 20-30%. Then, in subsequent rounds, the dilution occurs by 6-10% per round.

The task of startup founders is to reach the moment of liquidity (the ability to sell their share partially or completely) with a sufficiently high share that motivates work. How much is that? As a rule, for a billion-dollar company, according to the company’s valuation, it is 10-25% for the main founder.

***

My book “The role of a CFO: Motivating people, managing assets and hedging risks”