In the process of studying the report on global migration (World Migration Report 2024 – added to the channel chat), I thought that I did not know a normal international fintech service for migrant workers. But this is a market volume of hundreds of billions of dollars per year in international transfers (anchor product for migrant workers) and several trillion in receipts (essentially payroll).

By normal service I mean basic banking services for storing funds in current and savings accounts, as well as replenishing accounts and transfers to home countries (usually receiving in another currency). The latter is the most common and costly for migrant workers – the cost of transferring money to a family in another country is usually 5-10% with a minimum amount and a transfer fee, a high cost for conversion into the received currency. Not to mention that often the services and interfaces themselves are far from modern fintech and advanced banking applications.

I currently live and work in Dubai, so I am looking at data for the MENA region (UAE, Saudi Arabia, Oman, etc.). The region’s economy is built literally on the labor of migrants from South Asia (India, Pakistan, Bangladesh), Southeast Asia (Philippines, Indonesia, Malaysia, etc.) and African countries. I also look at the data on the CIS as relevant for the channel’s readers. Information – World Bank (I add the brief to the chat).

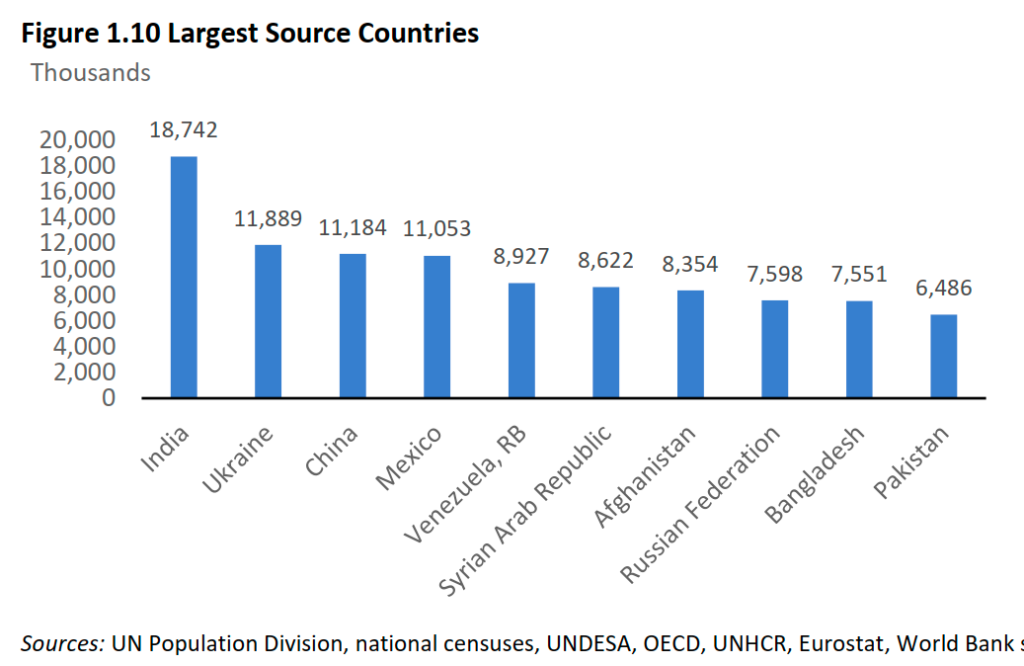

Number of labor migrants: 200-250 million per year. The world’s largest donors of labor migration are India, Mexico, the Philippines, China, Pakistan, Egypt, Bangladesh, Nigeria, Ethiopia, and Kenya. In Europe – Romania, Poland. In the CIS – Tajikistan, Uzbekistan, Kyrgyzstan.

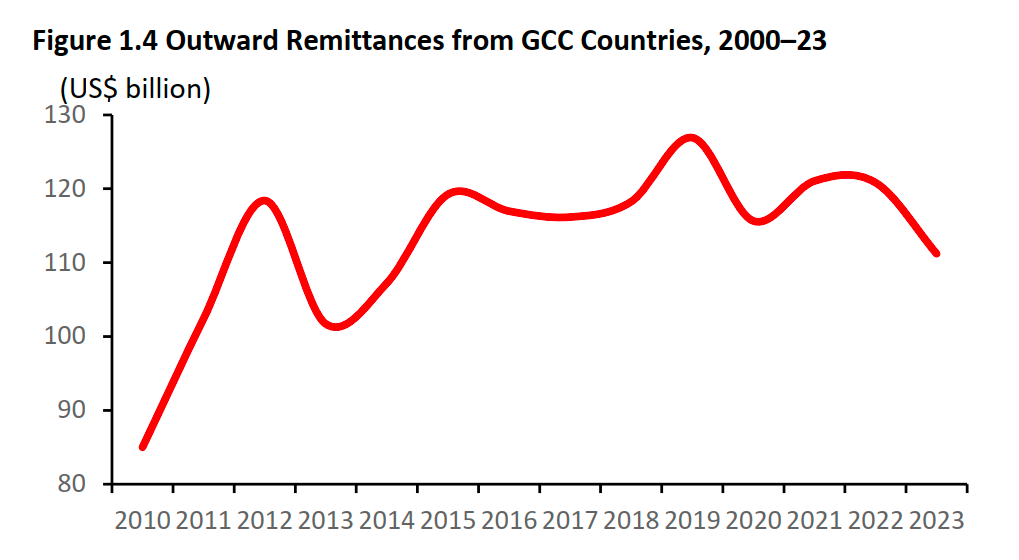

- Remittances: about $670 billion per year. The global volume of the money transfer market is about 880 billion dollars, including 670 billion to non-first world countries. More than $100 billion of transfers per year come from the Gulf countries (GCC – UAE, Saudi Arabia, Kuwait, Oman, Bahrain, Qatar), mostly to South Asia.

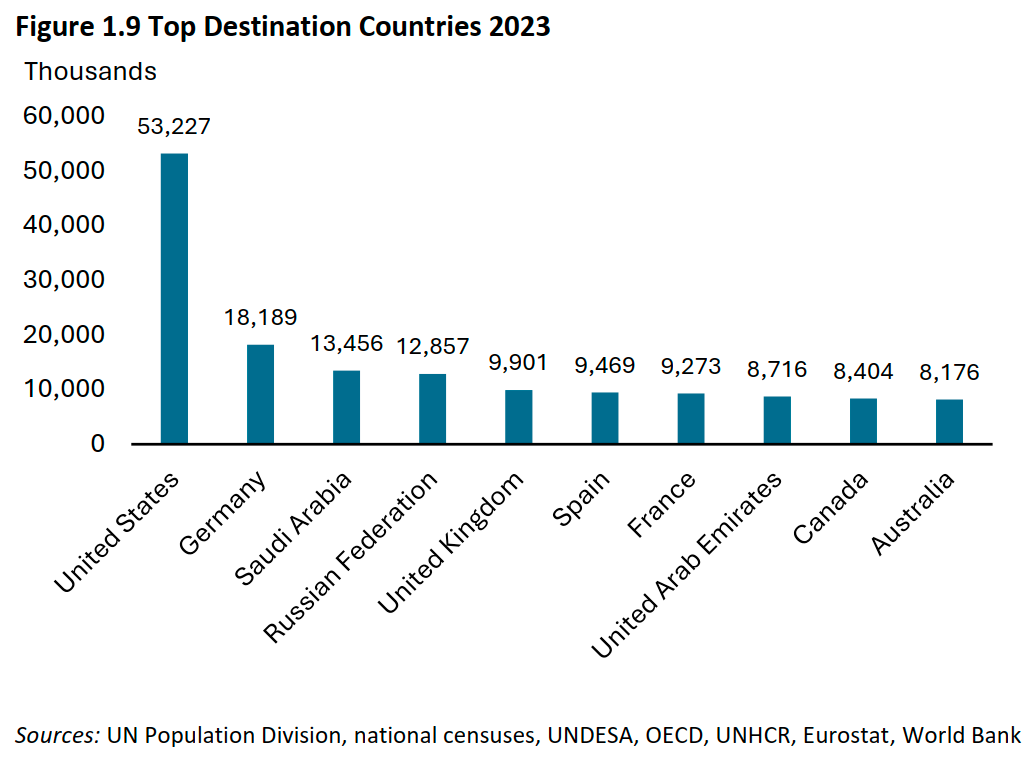

- Migrant income: $600-2000 per month. The average annual income of a migrant (usually from Asia and Africa) is from 8-10 thousand dollars in MENA (mostly South and Southeast Asia), 15-20 thousand dollars in the EU and up to 25-30 thousand dollars in the USA ( most are from South American countries), in the Russian Federation about 12 thousand dollars (migrants from other CIS countries).

Average monthly costs for transfers: $15-20 per month. According to the World Bank, the average cost is about 7% of the transfer amount, which greatly depends on the country where the migrant works, but on average fluctuates in the range of $200-300 per month. In certain corridors, for example between African countries, the cost of transfer reaches 35% of the amount.

Of course, this is not an empty market. The Emirati network of exchangers Al Ansari and fintech Pyyple are actively developing their money transfer business, also offering microloans, cards and insurance services for migrants. Latamian D-local provides the infrastructure for collecting from merchants and paying out to performers around the world. Zolotaya Korona has been operating in the CIS for a long time, startups like planet9 are appearing. But these are expensive and, in my opinion, insufficiently consumer-friendly and user-friendly services.

It should be noted that the majority of labor migrants remain underbanked – insufficiently covered by banking services, since in their home countries they often do not have work, and in the countries where they work they occupy the lowest social status. Local banks, for example in the UAE, are, to put it mildly, reluctant to accept such clients. On the African continent, monetary transactions are often carried out through cash transfers with bus drivers traveling between capital cities.

Statistics show that migrants play an important role in the economies of their countries, sending home significant amounts of money. For example, the amount of income from labor migrants to Tajikistan is equal to about 40% of the country’s GDP, to Kyrgyzstan – about a quarter of GDP.

If I were now launching an international fintech project, I would very closely study this particular segment of users and products – it is growing steadily and is clearly not sufficiently covered by financial services (insurance, deposits and long-term savings plans, loans, services for searching and comparing financial products).

The data file has been added to the Telegram channel CFOblog

***

My book “The role of a CFO: Motivating people, managing assets and hedging risks”