Behavioral economics is a fairly relevant area of research by recent Nobel laureates in economics, such as Richard Thaler. Interestingly, this is a very practical area for both business and personal effectiveness. It combines elements of psychology and economics to explain how people make decisions.

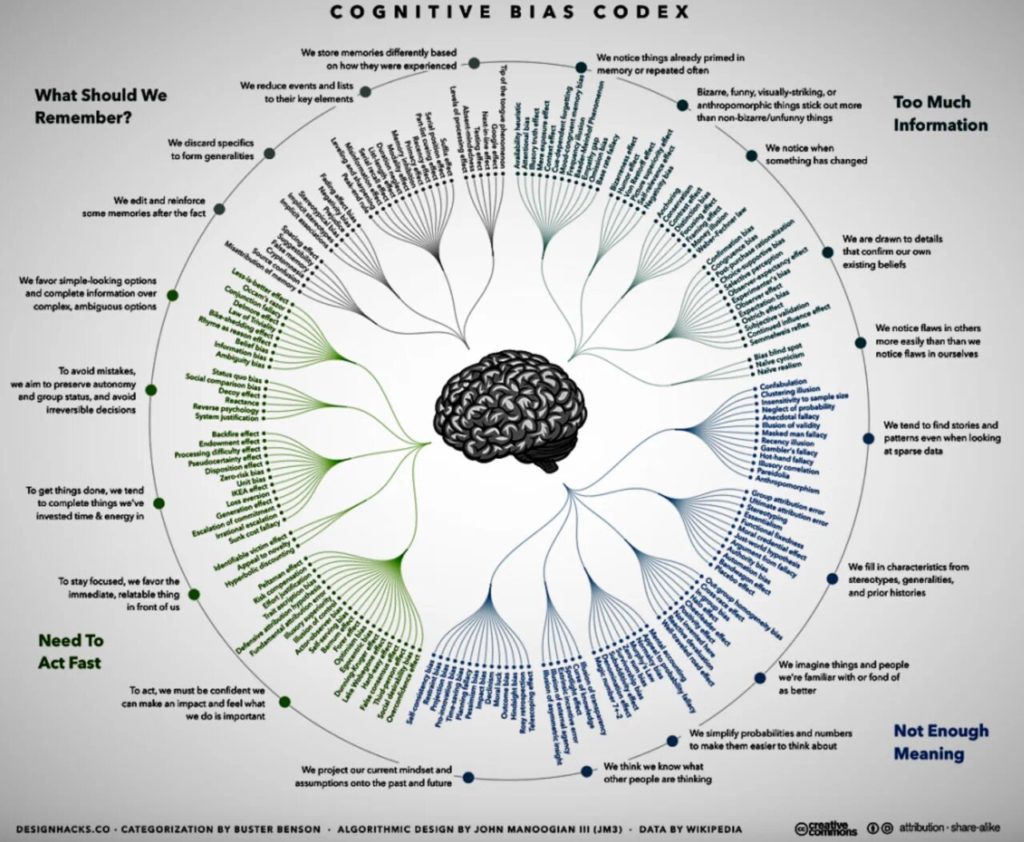

I am currently reading “Predictably Irrational” by Dan Ariely, having previously studied Richard Thaler and the well-known Daniel Kahneman. Their books use numerous examples to show that people do not always act rationally, and their decisions are often influenced by various incentives and cognitive biases.

The anchoring effect is one of the key examples of behavioral economics. Dan Ariely describes how people are heavily dependent on the initially offered information (anchor) when making decisions. For example, if a person is shown an expensive product before being offered a cheaper one, they will tend to evaluate the second product as a good deal, even if its price is objectively high.

Bounded rationality. Richard Thaler and Cass Sunstein in their book “Nudge” discuss the concept of bounded rationality, when people are unable to process all available information to make optimal decisions. Instead, they rely on simple heuristics and rules.

An example is choosing a retirement plan: Providing more options often leads to analysis paralysis, as a result of which people choose the standard default option, which may not be optimal for them, or even designed to their disadvantage. And this is despite the fact that choosing a retirement plan is one of the most important decisions in a person’s life, and made in adulthood.

Loss and gain. Daniel Kahneman and Amos Tversky in their prospect theory describe the asymmetry of perception of losses and gains. People tend to react more strongly to potential losses than to similar gains. This explains why insurance is so popular: people are willing to pay for insurance to avoid potential losses, even if the probability of these losses is small.

Social influence. Ariely shows in his research that people often succumb to group pressure and social norms, even if it goes against their personal preferences. An example is the social proof effect, when people begin to consider a popular opinion or action to be correct simply because many others adhere to it.

Incentives in real examples:

Increasing energy efficiency. Richard Thaler and Cass Sunstein describe successful examples of applying behavioral economics to energy consumption. The banal inclusion of information about how much energy their neighbors use encourages people to reduce their energy consumption, motivating them to keep up with others.

Increased organ donation. In countries where organ donation is implied by default (opt-out), the percentage of donors is significantly higher than in countries with an opt-in system. This is one of many examples of how important the default choice is and how it affects decision making.

Behavioural economics, using not always obvious examples and results of field research, provides an understanding that our decisions are often determined not by rational considerations, but by a multitude of incentives and cognitive biases.

Understanding these mechanisms allows us to develop more effective strategies and policies aimed at improving people’s behavioural patterns. Needless to say, knowledge of these mechanisms and patterns allows you to use them in business, and ignorance increases the risk of manipulation.

***

My book “The role of a CFO: Motivating people, managing assets and hedging risks”