Most companies traditionally live by annual planning, collecting the budget in the fall for the next year. This is usually difficult and painful for all participants in the process – the financial department, heads of business areas and their deputies, the board of directors and even shareholders.

Why it happens? In the traditional budget cycle, planning occurs rarely, so each time it becomes stressful, knocking the leaders of the business and service units out of their routine tasks. Consequently, they pay insufficient attention to planning, which ultimately leads to setting inaccurately developed goals.

Traditional annual budgeting is so ineffective that it becomes outdated, becomes irrelevant sometimes even before the start of the year for which it was painfully agreed upon and approved in several iterations with the involvement of many people in the company. If leaders hold monthly sessions with financiers, they get used to planning responsibly and will come to annual budgeting already prepared.

If you, as a finance manager or a top manager, are forced to use annual planning at the request of shareholders and investors – in fact, this is a requirement not of operational management, but of external stakeholders, then you can use rolling, monthly updated budgeting. It really brings benefits in operational management and focusing on the company’s goals, and also allows you to collect an annual plan in a natural way.

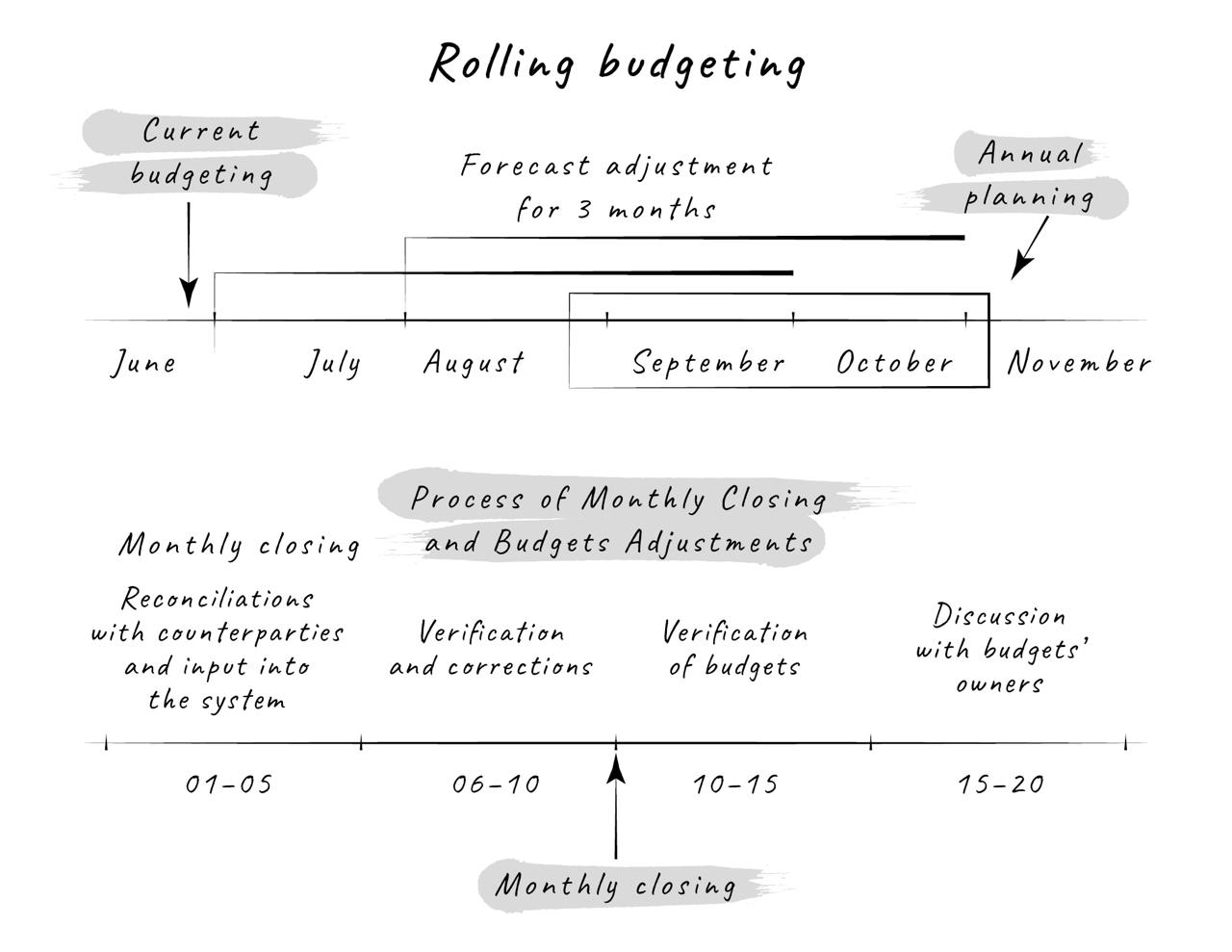

Rolling budgeting implies a monthly update of the plan based on the last closed periods and current short-term forecasts. Technically, it looks like this:

1) The month is closed;

2) A plan-fact comparison for the last period appears;

3) A joint analytical session-meeting is held with department heads – budget holders responsible for business indicators;

4) The plan for the next three months is clarified.

In such a system, you go through the budget process monthly, teaching business units to calculate and plan results over short periods and frequent iterations. This forces department heads to review or reconfirm (which is also useful) their indicators over short and high-frequency planning intervals, and as a result, the team and content will be prepared for the annual planning procedure.

It is useful to implement scenario analysis – to do this, add the ability to instantly edit drivers that are relevant to your business. For example, for an online marketplace, this is traffic, conversion, cost of a lead from various marketing channels, margin or commission, percentage of repeat sales from cohorts, cost of customer return, dynamics of operating costs for repeat sales.

Deep, systematic, monthly forward looking analysis, conducted together with business leaders, will help you prepare for the standard annual budgeting process and stay in good financial shape (from an analytical point of view) throughout the year. For standard annual planning, I recommend holding a strategic budgeting session in August-September with key business leaders and budget holders.

I believe that such an analysis of monthly indicators with subsequent refinement of the forecast for short-term and long-term periods, reinforced by scenario analysis, is the best budget process that allows you to move away from cumbersome and often irrelevant annual planning after just a few months. This is a logical evolution of budgeting processes.

In fact, rolling planning of income and expenses does not cancel the annual forecast, which is very useful as a tool for forming medium-term budgets and allocating resources. It just works effectively only together with rolling budgeting.

***

My book “The role of a CFO: Motivating people, managing assets and hedging risks”